Invest in a Greener Tomorrow Before April 29

We’re making it easier for people to buy native plants. Invest in our company and our planet’s future. Our funding round will close April 29, 2024.

| $2.50 | $250 | 800,000 |

| Share Price | Min. Investment | Shares Offered |

$5,262,660 committed to date

Investment Levels & Bonus Rewards

Invest in a Greener Tomorrow, Today

Your investment powers sustainable growth for our planet and your portfolio.

- Your investment will accelerate our mission, allowing us to reach more communities, support more small farms, and make a bigger environmental impact.

- As an investor, you’re not just a stakeholder in our company; you’re a stakeholder in our planet’s future.

- Together, we can make a transformative impact on our environment while enjoying financial growth.

Key Highlights

-

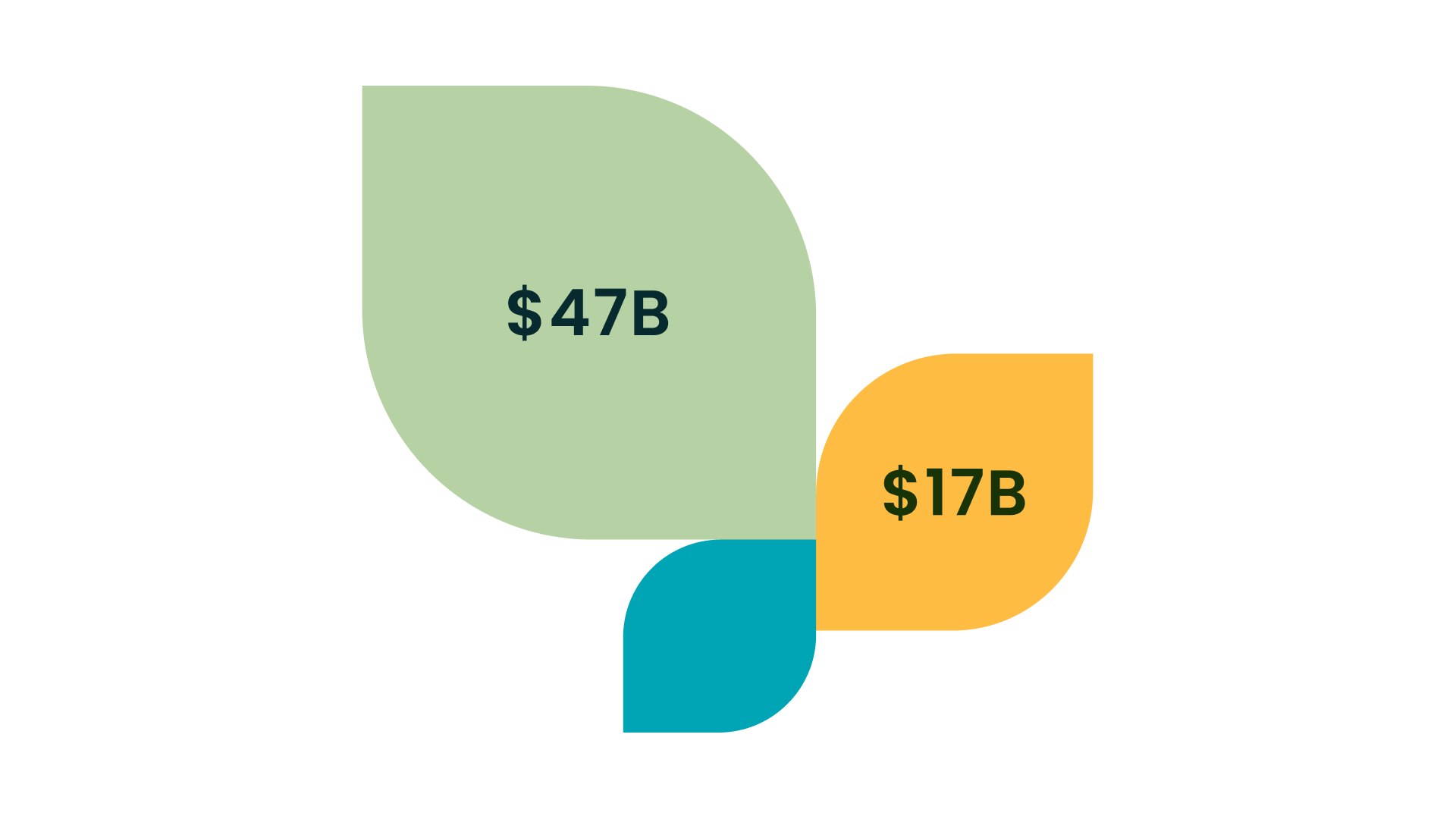

Over 71 million American households garden, spending $47 billion on gardening supplies.4

-

Big box retailers sell fast moving "pretty" plants with no concern for biodiversity or wildlife needs.

-

Most growers lack the skills and infrastructure needed for direct-to-consumer (DTC) solutions.

-

Our company is built upon 50 years of research and intellectual property and uniquely positioned to guide, advise and connect gardeners with native plants.

-

GFW makes it easy for consumers to order curated (zip code specific) native plants delivered to their doorstep.

-

Climate change and urban development are causing a severe loss of habitats, leading to a decline in essential wildlife.

-

When consumers are educated about the advantages of native plants, they readily embrace the practice of planting them.

Our Mission

To revolutionize the way people plant, by connecting the network of consumers, growers and fulfillment with a single platform.

We offer scientifically-backed, sustainably grown native plants that not only beautify landscapes but also create habitats where wildlife can thrive.

How We Do It:

-

Educate and empower individuals to plant with a purpose and save wildlife.

-

Offer a seamless online platform for purchasing zip code-specific live plants and shrubs.

-

Build a network of accredited growers to meet the growing product demand.

-

Map wildlife habitats to measure impact and share inspiring stories.

Value Proposition

We’ve created a trusted one-stop ecommerce solution for the curation and sale of native plants tailored specifically to a customer’s location, needs, and aspirations. (We do for native plants what Stitch Fix does for clothing and Blue Apron does for in-home meals.)

We are connecting the hyper-fragmented native plant market, with the world’s best content and customer experience. We make it easy for anyone in the US to imagine, design, plant, and enjoy amazing sustainable, eco-friendly gardens which help nature and the environment.

The Crisis

Our planet is facing a significant decline in wildlife due to the escalating climate crisis and the loss of over a million acres of urban and suburban habitat annually. Key species, such as the monarch butterfly and various songbirds, are rapidly disappearing.

The Solution

For nearly 50 years, the National Wildlife Federation’s (NWF) Garden for Wildlife™ (GFW) program has been at the forefront of educating and empowering individuals to plant with a purpose: saving wildlife.

The Problems We're Solving

-

Finding Native Plants Is Difficult

Big box retailers sell fast moving “pretty” plants with no concern for biodiversity or wildlife needs.

-

Knowing What's Native Is Confusing

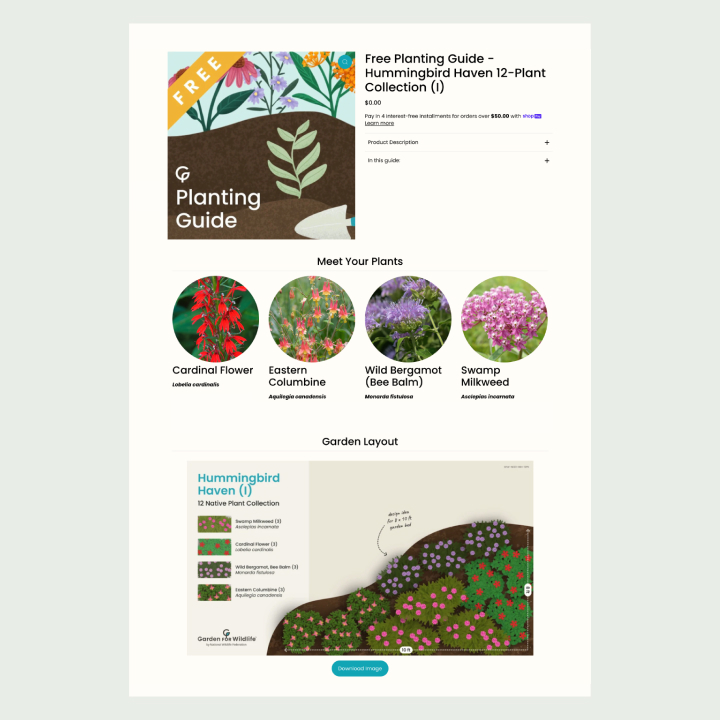

Our online platform eliminates the need for research, curated region-specific native plants are delivered to your doorstep.

-

The Current Native Plant Supply is Fragmented

Most native plant growers are "mom & pop" operations that lack the expertise and infrastructure needed to provide a DTC solution.

-

Lack of Public Awareness on the Need for Native Plants

Many people are unaware of the positive impact they have on the environment and wildlife when they plant native plants.

The Ground Has Shifted

A recent survey found increased interest in wildlife-friendly gardening, with more people buying native plants to support pollinators like butterflies, bees, and birds. National publications regularly publish articles on the need for native plants.

Together We'll Transform How Generations Plant

With your investment, you are taking an active role in:

-

Addressing the Native Plant Gap

We provide an extensive selection of native plants and shrubs, sustainably grown and backed by 50 years of scientific research.

-

Improving the Buyer’s Experience

Our online platform eliminates the need for research, curated region-specific native plants are delivered to your doorstep.

-

Educating the Consumer

We’re much more than plants. Since 1973, the Garden for Wildlife program has been at the forefront of educating and empowering individuals to plant with a purpose: saving wildlife.

Revenue Channels

GFW sells a growing range of items – from native plants to gardening merchandise to habitat certification (with more to come) through three channels:

-

DTC

Direct to consumer today online, and will expand to partner retail channels.

-

B2B2C (New Markets)

Partnerships with organizations such as school PTAs and Scouting BSA. We have successfully piloted selling through a Rotary club and are now focused on scaling. Next we intend to partner with corporate wellness programs, work with landscape and restoration projects, and expand partnerships with homebuilders.

-

B2G2C (New Markets)

Using existing government programs that subsidize native plantings such as lawn replacement for homeowners and wholesale supply to NWF restoration programs throughout the country.

We Provide Access to Native Plants And Much More…

With over 50 years or research and intellectual property, Garden for Wildlife is uniquely positioned to guide and advise beginner and younger generation gardeners on ways they can can have an immediate impact.

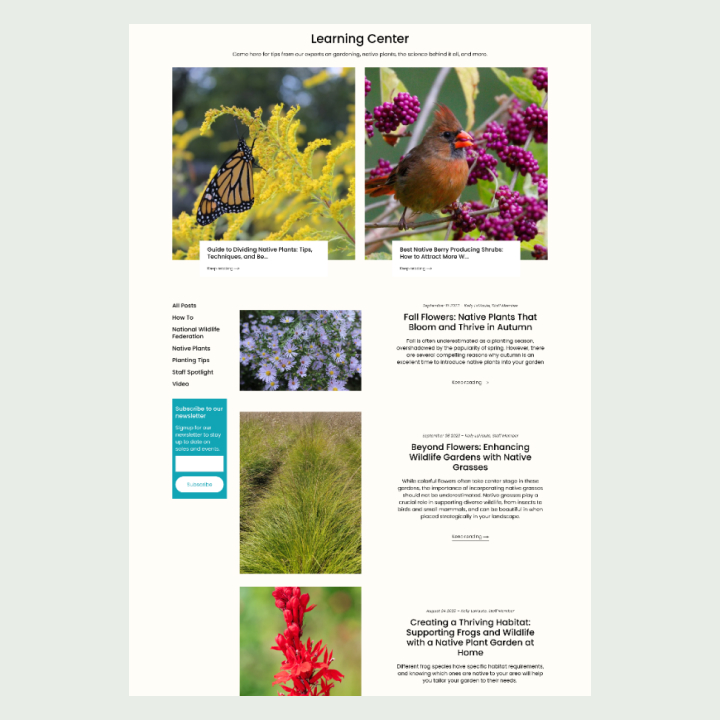

Educational Website Content

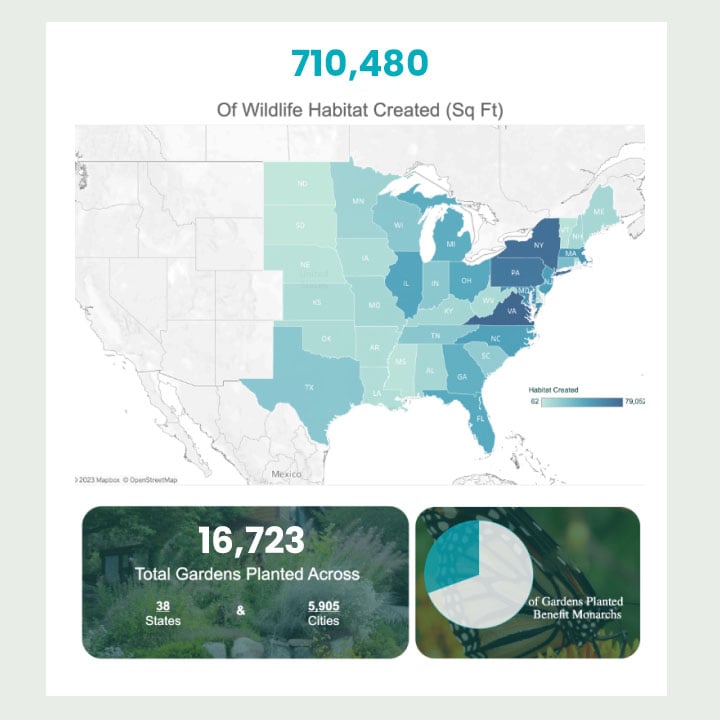

Live Impact Measurements

Curated Planting Guides

Our Leadership Team

With 125+ years of combined experience with leading e-commerce, technology, supply chain, and horticulture companies our leadership team has the relevant experience and knowledge.

Shubber Ali

CEO

Mark McEneaney

CFO

Chris Vanderbilt

VP Operations

Trisha Singh

VP Platform

John A. Booth

VP Marketing

| Competitor Type | Common Issues | Garden for Wildlife™ Solution |

|---|---|---|

| Big Box Retailers | ❌ Sell fast-moving, often invasive or annual "pretty" plants. | Offer native plants that are both beautiful and beneficial. |

| Local Nurseries | ❌ Limited selection of native plants. | Provide a diverse range of native plants customized by zip code. |

| Online Retailers | ❌ Require customers to do their own research on native plants. | Offer a user-friendly platform with all the information you need for informed choices. |

The Competitive Landscape

| Competitor Type | Common Issues | Garden for Wildlife™ Solution |

|

Big Box Retailers |

❌ Sell fast-moving, often invasive or annual "pretty" plants. |

Offer native plants that are both beautiful and beneficial. |

|

Local Nurseries |

❌ Limited selection of native plants. |

Provide a diverse range of native plants customized by zip code. |

|

Online Retailers |

❌ Require customers to do their own research on native plants. |

Offer a user-friendly platform with all the information you need for informed choices. |

Why Invest Now?

The demand for native plants is surging. Over 71 million American households enjoy the benefits of gardening, spending $47 billion dollars on gardening supplies.1

Recognizing the need for a nimble business solution, the National Wildlife Federation (NWF) spun out GFW Inc as a for-profit company, primarily owned by NWF, to accelerate its growth more effectively than from within a non-profit framework.

This new venture is built upon the foundation and expertise of NWF's 50-year legacy with the Garden for Wildlife program. Today we are inviting the public, our customers and partners to indicate their interest for investment in our company.

Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise - you are buying a piece of a company and helping it grow.

How much can I invest?

Accredited investors can invest as much as they want up to the remaining amount available in the offering. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

What are the tax implications of an equity crowdfunding investment?

Who can invest in a Regulation CF Offering?

What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

When will I get my investment back?

The Common Stock (the "Shares") of Garden for Wildlife (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Can I sell my shares?

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

Exceptions to limitations on selling shares during the one-year lockup period:

- The company that issued the securities

- An accredited investor

- A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

How can I learn more about a company's offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email:

How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

What relationship does the company have with DealMaker Securities?

Regulated Investment Crowdfunding requires companies to use an approved intermediary when making an offering. DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, is the Intermediary for this offering and is not an affiliate of or connected with GFW. Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

Why is my personal data required to make an investment?

Your answers are used to generate the Subscription Agreement and are required to proceed with an investment. Certain information is also used to process anti-money laundering (AML) verifications and conduct background investigations for compliance purposes which are required to be conducted by securities and banking regulations.

How does Dealmaker Securities protect my personal data?

Security and privacy are of the utmost concern to DealMaker. DealMaker uses the latest security software and works with some of the largest and most established brokerage firms and law firms. The Dealmaker platform provides investors with their own private portal to retain information on their investments. Your contact details cannot be used by or sold to third parties. For more detailed information on DealMaker policies and procedures, you can review DealMaker's terms and conditions and their privacy policy from the following links.

Terms of Use: https://dealmaker.tech/terms

Security: https://dealmaker.tech/security

Privacy Policy: https://dealmaker.tech/privacy

Take Action Invest Now

Be the first to seize this unique opportunity for investment in Garden for Wildlife™. Together, we can make a transformative impact on our environment while enjoying financial growth.

Equity crowdfunding investments in private placements, and start-up investments in particular, are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest in start-ups. Companies seeking startup investment through equity crowdfunding tend to be in earlier stages of development and their business model, products and services may not yet be fully developed, operational or tested in the public marketplace. There is no guarantee that the stated valuation and other terms are accurate or in agreement with the market or industry valuations. Further, investors may receive illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity concerns.

DealMaker Securities LLC, a registered broker-dealer, and member of FINRA | SIPC, located at 4000 Eagle Point Corporate Driv, Suite 650, Birmingham, AL 35242, is the Intermediary for this offering and is not an affiliate of or connected with the Issuer. Please check our background on FINRA's BrokerCheck.

DealMaker Securities LLC does not make investment recommendations.

DealMaker Securities LLC is NOT placing or selling these securities on behalf of the Issuer.

DealMaker Securities LLC is NOT soliciting this investment or making any recommendations by collecting, reviewing, and processing an Investor's documentation for this investment.

DealMaker Securities LLC conducts Anti-Money Laundering, Identity and Bad Actor Disqualification reviews of the Issuer, and confirms they are a registered business in good standing.

DealMaker Securities LLC is NOT vetting or approving the information provided by the Issuer or the Issuer itself.

Contact information is provided for Investors to make inquiries and requests to DealMaker Securities LLC regarding Regulation CF in general, or the status of such investor’s submitted documentation, specifically. DealMaker Securities LLC may direct Investors to specific sections of the Offering Circular to locate information or answers to their inquiry but does not opine or provide guidance on issuer related matters.

Source 1: Bees

Source 2: Birds

Source 3: Butterfly

Source: 4. Bigger Garden

Source 5: TAM & Plant Market

THIS WEBSITE MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY'S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS "ESTIMATE," "PROJECT," "BELIEVE," "ANTICIPATE," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT'S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

.png?width=1200&length=1200&name=home-news-415x415-washington-post(2022-01-19).png)

.png?width=1200&length=1200&name=home-news-415x415-hgtv(2022-01-19).png)

.png?width=1200&length=1200&name=home-news-415x415-martha-stewart(2022-01-19).png)

.png?width=1200&length=1200&name=home-news-415x415-earth-911(2022-01-19).png)

.png?width=1200&length=1200&name=home-news-415x415-better-homes(2022-01-19).png)